Oct 1, 2024

Product

Improvements

Workspaces

You can now invite collaborators to have access to all productions under your Workspace. Learn more

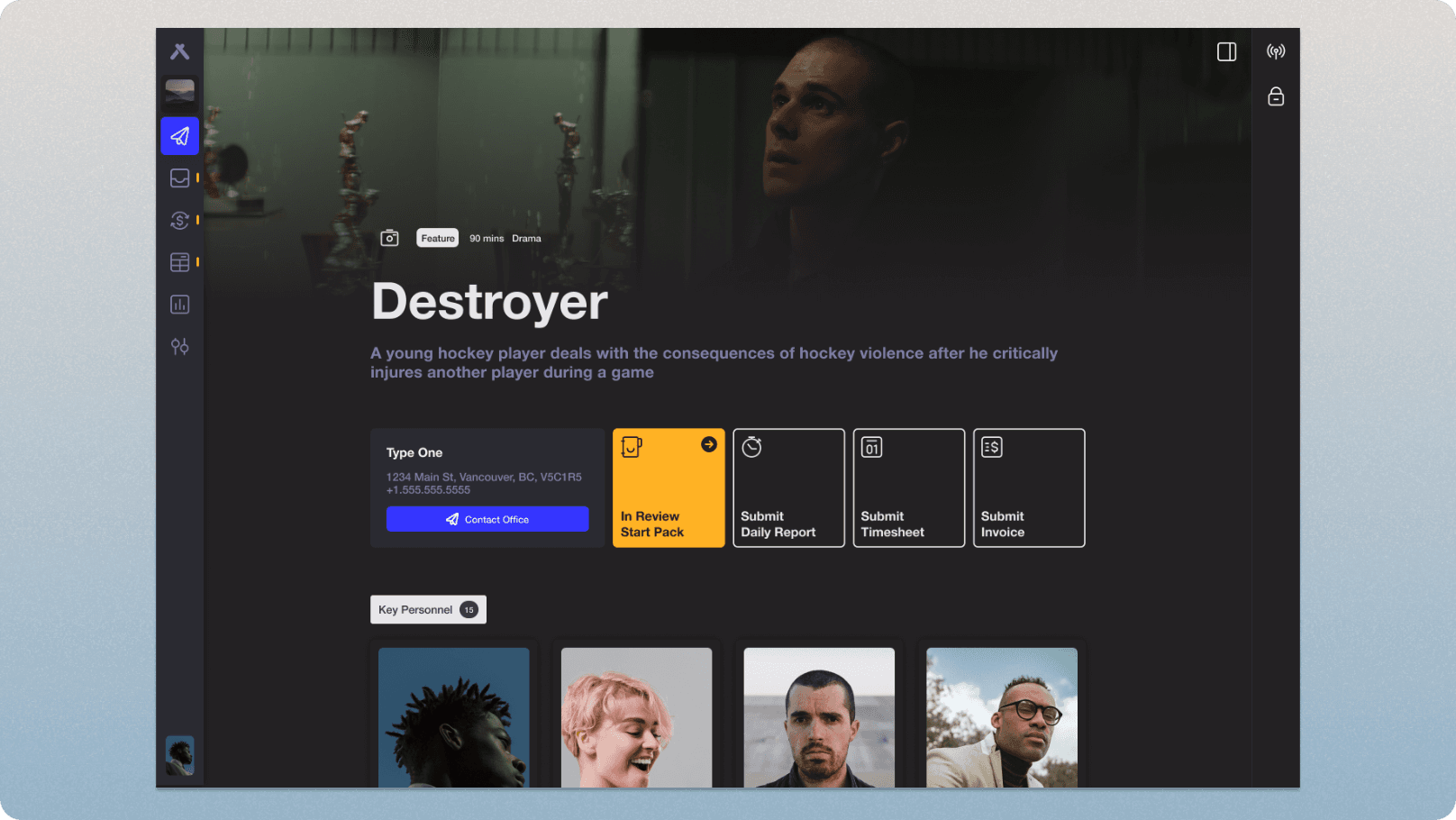

Start Packs & Onboarding

Account and Group Codes can now be added directly to a Start Pack, seamlessly carrying over to corresponding Timesheets, Invoices, Payroll Runs, and more.

Workers can now input their Federal and Provincial claim amounts on TD1 forms, enabling more accurate payroll calculations.

A new, fully customizable residency document model allows clients to specify how many documents they want to collect from workers for tax credits. For example, some production companies may require a Notice of Assessment plus three additional residency documents.

The colors of custom tags on Start Packs have been revised for better clarity.

The onboarding process now clearly instructs workers to upload only personal residency documents, not corporate ones.

Accounts Payable

Invoice numbers and the ability to add custom tags were added to the Accounts Payable overview page so you can have more ways to keep track of invoices.

Timesheets

Timesheets can now be submitted on behalf of someone else, making it ideal for department heads to submit timesheets for their entire team.

On the Timesheet overview page, you can now see which payroll runs Timesheets have been added to

Worker deal points, including the overtime rate structure, are now accessible directly within a timesheet and can be edited as needed.

Timesheets are blocked from approval if the corresponding Start Pack has not been approved, ensuring compliance before payroll processing.

The maximum hours allowed on a timesheet have been adjusted to 4,700 hours to accommodate extensive overtime.

Added support for QST (Quebec Sales Tax) on timesheets for the Quebec region.

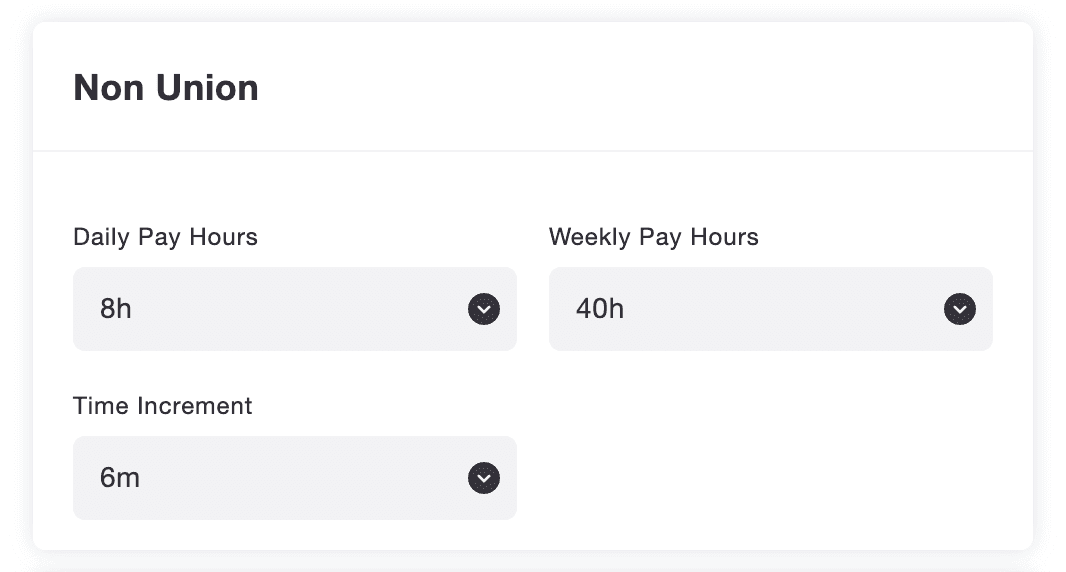

Non-union overtime defaults—such as daily and weekly pay hours and timesheet time increments—can now be set in production settings to automate payroll. Non-union time increments can be set to 1, 6, or 15 minutes, and the standard union increment of 6 minutes can now be overridden.

Payroll

In each payroll run, you can now review a comprehensive list of workers along with their pay summaries.

Custom names for payroll runs can now be set (ie. Payroll Run 08 for Cast, Payroll Run 09 for Crew)

Our Hours to Gross (HTG) engine has been updated to:

Handle two types of turnaround penalties, depending on whether a worker's previous day ended in overtime.

Automatically calculate and apply meal penalties across all timesheets.

Additionally, Cast and Background Actors can now be included alongside crew members in payroll runs.

Accounting

Account Codes can now be edited directly from the "All Transactions" list, making it easier to identify missing or incorrect codes and quickly view cost allocations.

The wallet funding in Circus is also now tracked in the Journal

Imported charts of accounts default to the "Expenses" category but can now be adjusted to other account types such as Liabilities, Assets, Revenue, or Equity.

Fringe Tables for both union and non-union workers can now be edited directly, allowing for more flexible management of payroll costs.

Worker Profiles

Updated messaging in the paystubs section to provide clearer information for workers when no paystubs are available due to a lack of payroll activity.

Fixes

Fixed a bug that prevented the duplication of productions within a Workspace.

Improved the style of the date and week range picker for better clarity.

Corrected the reference ID name displayed in the transaction report.

When a payment from the production company wallet to a worker fails, funds will now revert back to the production company wallet instead of being fully transferred to the worker.

Resolved an issue where imported journal entries (via CSV) were not being grouped by the same reference number.

Fixed a bug that caused incorrect tax calculations on Timesheets for Loan-Outs, Cast, and Background Actors.

Workers are now required to connect a bank account during onboarding when the production has enabled Circus Payroll.

Removed the GST tax row for sole proprietors when duplicating a Timesheet.

Tax accounts in Accounting are now defaulted to the Asset Account Type.

Fixed an issue that prevented some users from connecting bank accounts.

Addressed rounding issues in timesheet labor calculations.

Corrected the TD1 flag on Start Packs, indicating whether the basic personal amount has been requested.

CSV budget imports are now blocked if the file contains duplicate account names.

Fixed variance colors on the cost report: over-budget accounts now appear in red (X,XXX.XX format), while under-budget accounts appear in green (X,XXX.XX format).